Our services for startups

Making Ideas Fly!

Search for investors

We acquire capital through business angels, venture capital or banks.

Public funding programs

We search and apply for public funding programs at EU, federal or state level.

Financial Plan

We create robust financial and revenue plans for investors or banks.

Business Model

We help with the development or optimization of business models.

Pitchdeck & Businessplan

We help to create convincing pitch decks or business plans.

Pitch coaching

We help startups prepare perfectly for an investor pitch.

We support startups in the acquisition of capital!

We have many years of know-how in applying for public grants and a broad network of investors and business angels.

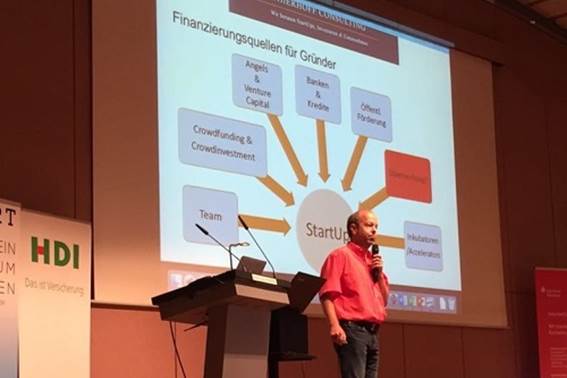

Financing alternatives at a glance

Opportunities for capital acquisition

We know the advantages and disadvantages of the various sources of funding and know exactly which sources can be used optimally in which entrepreneurial phase.

- Financing by the founding team can make sense up to a certain point in time.

- Angel Investments and Venture Capital, on the other hand, accelerate the growth process enormously.

- A marketing-effective product can also be financed through crowdfunding or crowdfunding.

- In the early stages, however, we often recommend applying for grant capital/public funding.

- In addition, we connect interested start-up teams with the relevant incubators and accelerators.

This is what sets us apart

Growth capital

Through our many years of work with various investors, venture capital companies, corporates and business angels, we have a wide network of investors for different phases of the company, industry priorities and investment orders.

- We identify and actively address the most promising investors for our customers.

- We prepare the teams strategically for negotiations and pitches.

- And we accompany them continuously until successful investment.

Further information on financing by Business Angels & Investors can be found here.

We develop and optimize innovative and sustainable business models!

We place a special focus on unique selling points and scalability.

Pitch Deck, Investor Presentation & Business Plan

How founders sell themselves successfully

A pitch deck, investor presentation, or business plan is primarily a sales document and the business card to the outside world.

- The documents serve to underline the probability of success of a business model and the plausibility and, if necessary, scalability of the KPIs and the other financial plan.

- For the acquisition of capital from investors, business angels or banks, a first attention-grabbing teaser, a conclusive pitch deck or business plan is essential.

- By focusing on business start-ups, we have extensive experience in creating and optimizing pitch decks, investor presentations and business plans, and support founders, startups and entrepreneurs in all necessary steps.

Pitch coaching and negotiation

Presentation of the business idea

A successful pitch can help start-ups to make an attractive financing opportunity. For this purpose, a presentation of the business model tailored to the investor is fundamental.

- Based on our many years of experience in dealing with investors, we prepare startups specifically for potential questions, reservations and conflicts and thus support proactive action.

- If there is an external participation, we strive to realize the best possible conditions for our clients.

- We provide comprehensive advice both before the negotiation process and during the process (no legal advice).

Revenue and financial planning

Securing future development opportunities

In fact, many young companies fail due to insufficient liquidity or too late a capital acquisition.

- Especially in the initial phase, every planning is subject to numerous unknowns, which can add up and have a significant impact on business activities.

- We therefore support start-ups and companies in a realistic financial planning and business valuation from the outset, so that future development opportunities are secured.

- Financial planning serves as orientation, increases planning security and can therefore be used to manage liquidity.

We support startups in applying for public funding.

We have already been able to apply for and process high six-figure funding at state, federal and EU level for innovative start-ups and projects.

Project and grant capital

In recent years, we have already very successfully acquired public, non-repayable grants for various innovative customer projects totalling a significant seven-figure sum.

- We have a detailed knowledge of the funding landscape (state, federal and EU programs) and the advantages and disadvantages of the various programs.

- Through our experience in project application and execution, we help companies to finance innovative and risky projects.

- On request, we will show different funding options and support the implementation of the project in the application process and the administrative implementation.

- Grants can be acquired for a wide range of industries, company sizes and projects.

Further information on public funding programs can be found here.

In doing so, we help founders

Have we aroused your interest?

Then we look forward to your contact and an interesting exchange of ideas.

We sit in Cologne and Berlin

Our headquarters in Cologne:

Thierhoff Consulting

Salierring 32

50677 Cologne

0221 / 430 75 68-0

info@thierhoff-consulting.de

Our branch in Berlin:

Freedom 12c

12555 Berlin

030 / 120 894 58

We are also happy to meet you in our branches in the Rotonda Business Club:

- Frankfurt Wiesenhüttenplatz 25 – 60329 Frankfurt

- Domstraße 10 – 20095 Hamburg

- Munich Luise-Ullrich-Straße 14 – 80636 Munich

- Königstorgraben 11 – 90402 Nürnberg

- Lautenschlagerstr. 23a – 70173 Stuttgart

- Elisabethstraße 11 – 40217 Düsseldorf